Seeking investment: Getting your business fit for investment

It all starts with ‘cash-flow’. Review (regularly) what’s coming in, what’s going out in order to optimise your cash position, particularly in a growing businesses where spend can quickly spiral out of control, unless monitored closely. You need t...

Seeking investment: What a Private Equity investor looks for

Certain firms exclusively pursue large-scale deals exceeding £100 million, while others concentrate on smaller transactions. Furthermore, some firms differentiate themselves with distinctive expertise, effectively assisting companies in internatio...

Seeking investment: Different types of investor

Seeking equity investment can bring a significant number of benefits to a business, not just an injection of cash, but investors can bring broader business experience, contacts and act as a critical sounding board, helping towards the development ...

Seeking investment: Debt vs equity

Most businesses start off self-funded by the entrepreneur (sometimes referred to as bootstrapping), and possibly with loans and investment from friends and family. Whilst many SME businesses will always grow organically and never take on any exte...

Back to basics: What is IHT?

No one likes to talk about death and hardly anyone like to talk about tax, so Inheritance Tax (IHT), being a tax that is predominantly in point when someone dies, is a difficult topic and one many don’t think about during their lifetime. Our late...

Accounting 101: What is leverage?

One of the terms often banded about in the corporate world and in the financial press is ‘leverage’. It can be the sort of terminology where you ‘kind of know’ what it means, but if you’re setting up a high growth business, it’s something you defi...

Residential property Capital Gains Tax 60-day reporting: Are you on top of it?

Three years ago, the government changed the rules on how Capital Gains Tax on residential property should be reported and paid, around the same time that they introduced the new HMRC digital service. The updates introduced a 60-day deadline for re...

How to stay on the good side of HMRC when claiming R&D tax relief and avoid penalties

It’s estimated that during 2020/21, over £400m was wrongly claimed by UK companies. As a result, HMRC has hired 100 additional staff to focus on R&D tax relief claims to try and reduce the scale of error and fraud in claims.

What does good governance really look like?

The starting point to answering this question is to consider what governance actually is and its purpose. The first version of the UK Corporate Governance Code, published by the Cadbury Committee in 1992 defined corporate governance as “the syste...

How electric company cars can save you and your employees a significant amount of money

It’s no secret that significant benefits, grants and reliefs are available to businesses and individuals when taking advantage of sustainable and renewable choices.

Why it pays to have Tax Investigation Insurance

Tax Investigation Insurance. It sure does sound important and a little ominous, doesn’t it? Well, it’s important stuff – for any business. If this is something you’re unaware of, don’t worry, you’re not alone.

The benefits of benchmarking for SaaS businesses

Attracting investment into SaaS businesses, transitioning business models in SaaS and investing into SaaS business is something Wilson Partners has been working on enthusiastically with clients and management teams over the last few years.

When to start thinking about FCA regulation

We’re all familiar with FCA regulation in some way or another, whether we know it or not. If you’ve ever taken out credit, applied for insurance, made investments or even if you just have a bank account, the organisation at the other end must be F...

Why ‘addressing worries’ is a core part of our strategy

We’ve all had concerns about money at one time or another. Whether business-related or personal finances, it’s not a particularly pleasant feeling. This is often compounded by the fact that, as humans (or maybe it’s a British thing), we generally ...

How software startups can use an EMI scheme to attract top talent

A struggle for businesses, not least startups, is attracting top talent. With the rise of remote work and booming growth in the tech sector, the software industry in particular is finding it difficult to find the right people for the job.

Create value through innovation

...none are more important than the company’s own culture, capabilities and internal systems – all of which are aspects of its governance. Unless companies are governed in a way that is conducive to innovation, they are unlikely to be in a positio...

Business Advisory – you are unique

For us, business advisory means that we recognise that every business is unique and therefore the advice given should be tailored to their needs, situation, environment, external influences and goals.

Completion Accounts or Locked Box?

There are then two widely accepted methods in the UK for adjusting the Enterprise Value to the Equity Value; “Completion Accounts” and “Locked Box”, which we explore further in this blog.

Investing in Software as a Service (“SaaS”)

In this blog, Dan James is discussing attracting investment, transitioning your business model from traditional consultancy to SaaS and investing in SaaS business.

Explaining Corporate Finance

Dan James explains the mystery, intrigue and workings of the corporate finance world.

Employees – How will you keep yours?

“People may take a job for more money, but they often leave it for more recognition.” – Dr. Bob Nelson, best-selling author and […]

The Rat is dead, long live the Ox – What the Ox can teach you about your business in 2021

The Ox is the second of all animals in the Chinese Zodiac. According to one myth, the Jade Emperor said […]

After the biggest year of change in a generation, is there still room for more change in your business?

'Collaboration' is on the rise, especially among SME's and I've been amazed to see just how much this can benefit businesses at little or no cost. Gone are the days of keeping cards close to your chest, this is the time to open dialogue with busin...

A view on business in 2021

What is also very clear is that entrepreneurs will not wait for the pandemic to end before taking action. Indeed entrepreneurs generally face periods of huge uncertainty with increased enthusiasm for the way ahead. We have seen this manifest itsel...

5 reasons why you need regular management reporting

By having regular discussions around the numbers, top advisers (and we can introduce you to one if you don’t know already), can assist with not only setting out a plan, but holding you to account to ensure you are making the best financial decisio...

Furlough scheme updated – Nov 2020

Under the extended scheme, the benefits will return to the same levels as August. The Job Support Scheme, which was scheduled to come in on Sunday 1st November, has been postponed until the furlough scheme ends.

It’s time to create a new culture in pursuit of cash excellence

At the start of the COVID-19 crisis, many businesses reacted quickly to stave of the imminent crisis and keep their […]

Winter Economy Plan – Pay as You Grow

Today, 24th September, Chancellor Rishi Sunak announced a new job scheme starting 1 November 2020 to replace the current Job retention (“furlough”) scheme which ends 31 October 2020.

Beware the dangers of recovery

It’s often said, and rightly so, that the most dangerous time for businesses is not going into recession but on the way out. During a recession cash balances and balance sheet reserves often shrink and the return to growth, which usually requires ...

How to apply for a ‘Restart and Recovery’ grant

we’ve created a couple of examples below of what support a client of ours could take advantage of and how best to describe it in the application. In this instance, we’ve referenced advice specific to cashflow to help future proof your business and...

The Government’s Restart and Recovery Grant scheme starts next week

From next Tuesday, 14th September, the Government’s Restart and Recovery SME Grants are open for application and you can apply for up to £3k for your business. The Government has made £20m of funding available to boost small businesses recovery fr...

Flexible furlough scheme update for September 2020

The latest statistics show over 9.6 million employees have been on Furlough since March and currently there are 1.2 million Furloughed in August. This amounts to over £34.7billion in grants from the Coronavirus Job Retention scheme which ends in O...

HMRC has published additional information on the job retention bonus

Employers will be able to claim a one-off payment of £1,000 for every employee they have previously received a grant for under the Coronavirus Job Retention Scheme (CJRS), and who remains continuously employed through to the end of January 2021.

No false hope in Sunak’s summer update

There was also a huge shot in the arm for the housing market with a temporary a cut in stamp duty which will leave 90% of house purchases tax free. Other tax cuts included a reduction in vat to just 5% aimed at the food, accommodation and attracti...

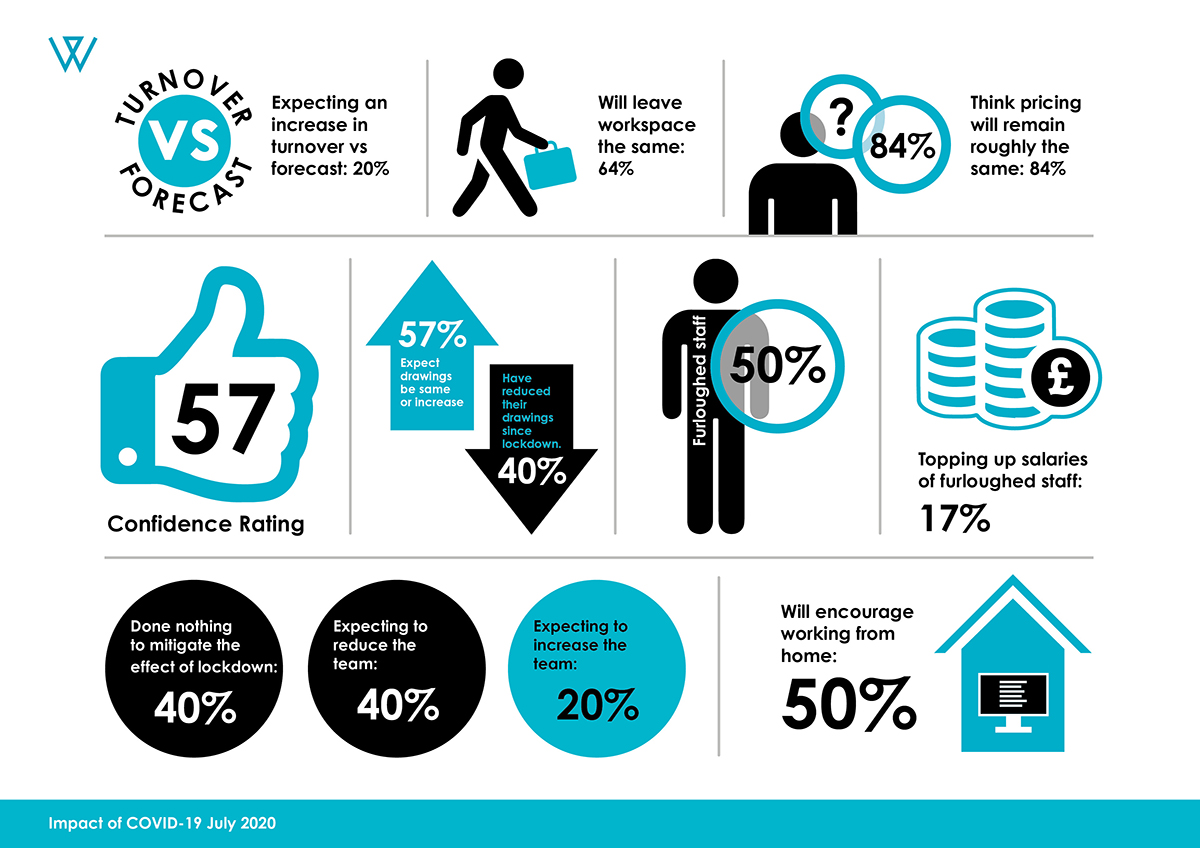

Research report: Business in the Thames Valley in the midst of COVID-19

Well, unsurprisingly COVID-19 and the lockdown measures have had a polarising effect across business. Whilst some have seen their sales fall off a cliff due to exposure to certain sectors such as retail or hospitality, others with exposure to more...

MORE FIRMS CAN NOW BENEFIT FROM THE FUTURE FUND

More start-ups and innovative firms will be able to apply for investment from the government’s Future Fund from 30 June: […]

Is diversification your route to continued success?

With many small businesses experiencing uncertainty, not to mention financial difficulties, many are looking at how they can adapt their […]

FLEXIBLE FURLOUGH IS COMING – BE PREPARED!

The Government, has confirmed further changes to the Coronavirus Job Retention Scheme (CJRS) with the introduction of flexible furloughing as well as the increased costs to employers, from 1 August, who have furloughed employees. Whilst it is wit...

PARENTS RETURNING TO WORK AFTER EXTENDED LEAVE ELIGIBLE FOR FURLOUGH

People on paternity and maternity leave who return to work in the coming months will be eligible for the government’s […]

APPLY FOR THE CORONAVIRUS LOCAL AUTHORITY DISCRETIONARY GRANTS FUND – ENGLAND

The Discretionary Grant Fund supports small and micro businesses that are not eligible for other grant schemes opened on the […]

7 pillars of success part 6 – Finance and Legal, interview with Duncan Bye

For part 6 of our ‘7 pillars of success’ series, we’re talking to our very own Duncan Bye. ‘Dunc’ is […]

It’s time to think like a start-up and act like a grown up – you need to be on top of your game to trade through the COVID-19 crisis

Beware also that as you trade through this, often the most dangerous time for a businesses is coming out of recession. Growth inevitably eats cash and so the funding of your business to allow that growth will be vitally important – especially if b...

Government Furlough Scheme Extended By Four Months

The changes to the current scheme will become clearer in the days and weeks ahead, but following a series of tweetson Rishi Sunak's account this afternoon, what we can tell so far is that the extension to the scheme is designed to offer flexibilit...

Should you consider cocooning your business during the COVID-19 crisis?

If your business has seen a huge drop in revenues in recent weeks due to the COVID-19 crisis, we’ve produced this blog to give you an idea of what cocooning (or mothballing) a business might look like and why and how you might do it in response to...

Our tips for keeping your head through the Coronavirus crisis

It’s now almost 3 weeks since Boris Johnson began his daily press briefings and Rishi Sunak unveiled the first raft […]

The Coronavirus Job Retention Scheme ***UPDATED 17th APRIL 2020***

The Coronavirus Job Retention Scheme is a temporary scheme open to all UK employers for at least three months starting […]

7 Pillars of Business Success, Part 5 – Operations

Introduction No matter what business you’re in, your ability to bring on new clients while maximising lifetime profit value of […]

Don’t feel isolated – 10 considerations for your business in the wake of Coronavirus (Covid-19)

Be aware of your responsibilities as a director. If you’re looking at a period where losses may be made and the long term viability of the business could be in doubt you will have to remember your responsibilities and duties as a director. It ma...

Huge support for UK plc: COVID-19. What action should you take NOW? ***UPDATED 27th APRIL 2020***

Coronavirus Job Retention Scheme Under the Coronavirus Job Retention Scheme, all UK employers will be able to access support to […]

7 Pillars of Business Success, Part 4 – Technology

Every market is now a technology market. For some that simply means using technology to do the same things faster […]

IR35 changes – is your business affected?

End user clients have to make a decision on the status of their contractors. HMRC have provided the CEST tool (check employment status for tax) to help with this but this needs to be used with care. This ‘Status Determination’ check needs to be pe...

4 New Year’s resolutions you need to make for your businesses, to give you more time, more money, more knowledge and stay motivated

he Government offers tax reliefs to reward UK businesses investing in innovation, known as Research and Development (R&D) tax reliefs. These can have a huge and valuable impact on small and large businesses.

7 Pillars of Business Success, Part 3 – Building a Team

As a business leader, the single most important decisions you ever make will concern the people you hire and the […]

7 Pillars of Business Success, Part 2 – Marketing Strategy

It’s no coincidence that the greatest business people of all time (Steve Jobs and Richard Branson to name a few) […]

Entrepreneurs’ relief – a very costly lesson

HMRC recognises that to start a business from scratch, then nurture its development, takes blood, sweat and tears. Their reward […]

Charity Begins at Work

The classic mantra says ‘Charity begins at Home’ but perhaps this should be amended in the modern day. After all, the most rewarding part of work for many members of staff, especially those in small and medium businesses, is the ability to give ba...

4 things to consider before jumping on the Black Friday bandwagon

Don’t be struck by Black Friday FOMO with your business Black Friday is quite a big deal in the UK […]

So, what IS Business Advisory – and why did we win an award for it?

We recognise that ‘Business Advisory’ is a widely used term amongst accountancy practices but to the majority of business people, […]

5 reasons why Making Tax Digital (MTD) is a positive move for business

Nobody likes being told what to do, not least by the tax man, but Making tax digital (MTD) is happening (in April 2019 for most businesses) and save for a few exemptions, your business will have to do it.

Where next for me and my business?

It’s never too early to think about your exit – 9 things you should consider to ensure you get the […]