Charity Begins at Work

The classic mantra says ‘Charity begins at Home’ but perhaps this should be amended in the modern day. After all, the most rewarding part of work for many members of staff, especially those in small and medium businesses, is the ability to give back to local communities and helping those who need it most. Although we at Wilson Partners salute anyone who braves the fine English weather with collection buckets, it doesn’t always have to be that way for businesses.

It’s not just small and medium firms that have bought into charity. Prominent global firms have made charity a core element of their messaging – Sage Group PLC have ensured that all staff can make an active contribution to the Sage Foundation every year, through paid opportunities for staff to contribute locally for five days a year.

As a business owner, supporting a charitable cause can be a fantastic way to actively make a difference, inspire and educate your workforce and bring your staff in line with your company goals and Mission Statement. It is little wonder that charity work is often marked at the pinnacle of Maslow’s Hierarchy of Needs because it embodies self-actualisation and is therefore extremely rewarding because you can actively see yourself making a difference.

Benefits of Charity Support for Businesses

Charity is becoming important for recruitment as well – people now want to work for companies that display social responsibility and working with a local charity is a great way to demonstrate this. Although this social aspect of charity is important for businesses, they can also benefit significantly from the financial incentives as well. You can reduce your corporation tax through this by giving the following to charity:

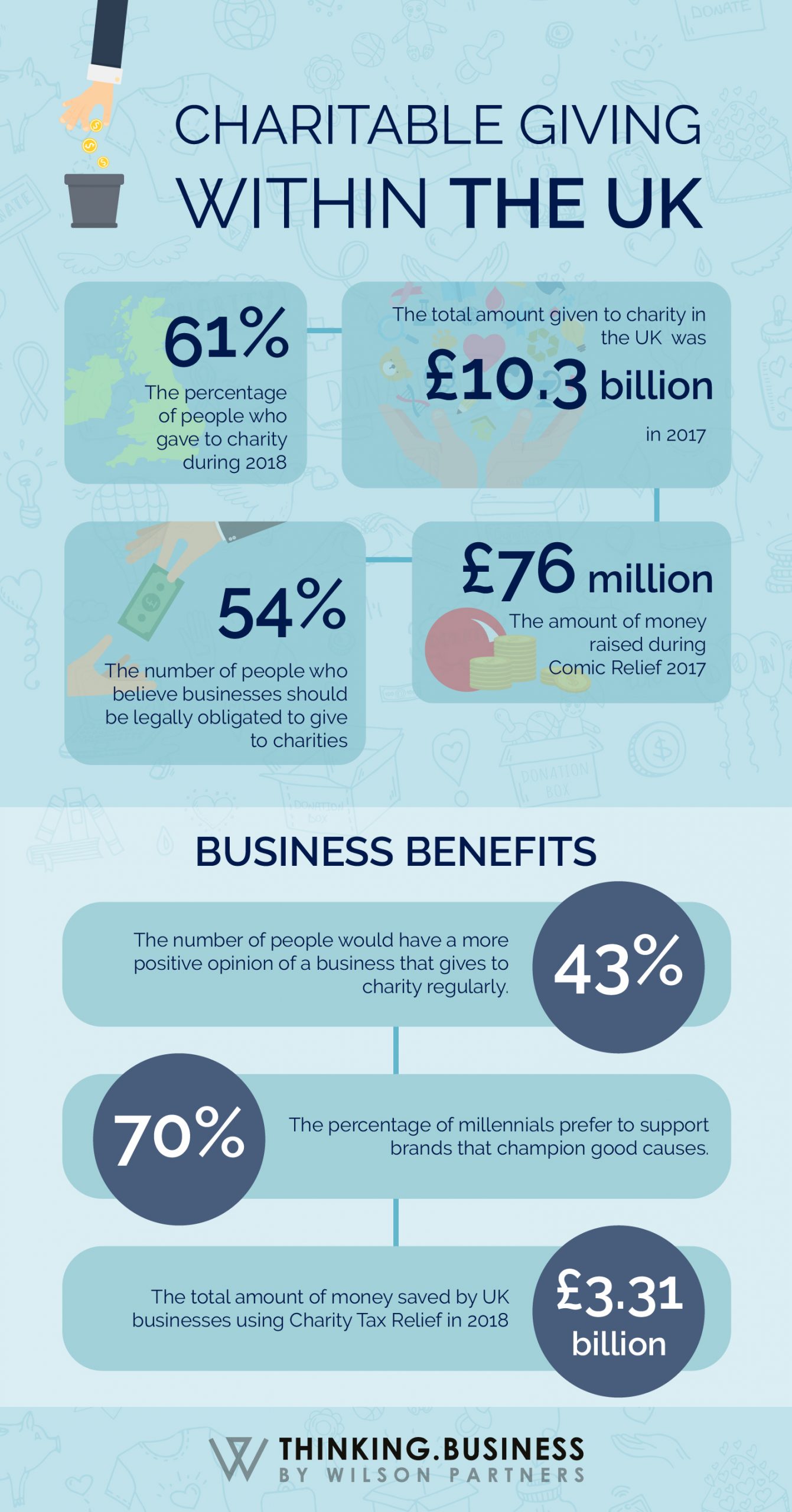

The infographic below outlines some key figures regarding charity for businesses in the UK:

Wilson Partners’ Charity Support

Wilson Partners have a proud history of being involved in a number of local charitable causes, including The Prince Philip Trust Fund and Daisy’s Dream.

The Prince Philip Trust Fund, established in 1977 focuses on supporting the elderly, the disabled, families and young people, with social support and the ability to develop creative art skills.

Wilson Partners’ own Ross Wilson has been involved with the Trust since formation in 1977 and has been a Trustee and Treasurer for a long time. The Trust have distributed over £2m in funds in over 40 years since the beginning and have assisted over 1,600 causes in the Royal Borough of Windsor and Maidenhead.

Daisy’s Dream is a Berkshire charity that supports and guides children and families who have been affected by close bereavements, or life-threatening illnesses and conditions. Through their flexible and unique services, they tailor support to every individual and aim to maximise the happiness of everyone, even during troubled and difficult times. Whether they are managing group events, training associated professionals, offering advice through meetings or telephone support they are an integral pillar in the local community. Wilson Partners have been directly involved in a number of events organised by Daisy’s Dream and we believe their purpose is extremely valuable for both the children and their families.

5 Key Things You Should Consider When Choosing A Charity Partner

We’ve selected these partners because we want to be a part of their journey and Wilson Partners have always placed giving back to the community at the centre of our business objectives. If you are only a small or medium business, however, this shouldn’t stop you from looking to support a local charity. Below, we’ve detailed five key points to consider when choosing your charity partner:

- Do you understand what the charity does, how they do it, and why? – The most satisfying thing for any business is being able to make a real difference to their charity partner. You can only do this if you understand what the charity does, and how they do it, but more importantly, WHY they do it like this.

- Is the charity the right size for my business? – If the charity is too big, some small businesses may feel pressured or overwhelmed with their efforts to support them, as they will never be able to match other larger supporters. Try and find a local charity that you can connect with, and don’t be afraid to pick a lesser known cause – often these are the ones that need support the most.

- What can you give back? – For some larger charities, a yearly donation or sponsorship fee can be the lifeblood of their organisation. However, for small local charities, foundations or causes, they might find a few days of volunteering, or even a period of local publicity infinitely more rewarding.

- How long are you going to support them for? – While some local charities might prefer to rotate between their supporters, others may want to create a long-term partner. Make sure you do your research and understand exactly what commitments you are making.

- Do you get anything back? – Although giving to charity should be rewarding in itself, many of them offer sponsorship deals for merchandising or even events. You shouldn’t expect anything, but some charities will want to thank you – even if it just means a nice Christmas Card.

Benefit Limits

If someone from the donating company receives a benefit from the charity in return for the donation (eg, tickets to an event), this must be below a certain value if the company wants to claim corporation tax relief. The limits are:

- Donation of £0 – £100: 25% of the donation or less;

- Donation of £101 – £1,000: £25;

- Donation of more than £1,000 – 5% of the donation (up to a maximum of £2,500).

These limits also apply to benefits given by the charity to any person or company connected with the donating company, including close relatives.

Conclusion

Of course, some big charity events are now annual fixtures on people’s calendars, such as Sport Relief, Comic Relief and Children in Need. Facebook have pledged to match the first £1 million donated this year on Comic Relief, so if you haven t given anything yet, be sure to help out one of the best causes in the United Kingdom. But equally, don’t be afraid to approach your local charity and see what you can do for them. You might be a life-saver for them.

There are different ways to claim tax relief depending on the type of donation you make and how you make it, but this is becoming an increasingly complex area for tax purposes and so this hassle can dissuade people from claiming it.

We recommend that you speak to an adviser about the possible tax implications of donating to charity. Contact Wilson Partners today and we’ll be happy to assist you wherever possible.

To read more about how you can claim Tax Relief Benefits, click here.

References for Statistics:

1: http://www.npt-uk.org/philanthropic-resources/uk-charitable-giving-statistics

2: https://www.cafonline.org/about-us/publications/2018-publications/uk-giving-report-2018

3: https://smallbusiness.co.uk/giving-charity-good-business-2540572/

4: https://www.comicrelief.com/about-comic-relief/history

5: https://smallbusiness.co.uk/giving-charity-good-business-2540572/

6: http://www.nielsen.com/us/en/insights/reports/2015/the-sustainability-imperative.html

Event

Webinar – Changes to the UK Trust Registration Service, May ’22

A short webinar and Q&A session with our Trust specialists Jodie Green and Sara Pedrotti. You can view the video and download the presentation here.

Download our free guide to the 7 pillars of business success

Read our free guide what you need to focus on to help you make better decisions and achieve your goals quicker.

Please complete our form to download the guide.

Sign up to receive alerts

Call us on 01628 770 770 for a no-obligation chat

You may also be interested in...

Meet the team in 90 seconds – Tom Bradbury

Introduce yourself Hi, I'm Tom and I am a Director in the Corporate Finance Team here at Wilson Partners. I started my career and did my training…

Inheritance Tax: Let’s get organised

Let’s face it, none of us want to think about when we’re going to die, let alone talk about it, or consider if there’s going to be a tax bill waiting…

Seeking investment: What a Private Equity investor looks for

What a Private Equity investor looks for Private equity investment is a fundamental source of business funding that plays a pivotal role in…