I’m worried we’re paying too much tax

When it comes to tax, you don’t know what you don’t know and it’s an uncomfortable feeling when you think you might be giving wealth away on a regular basis, which with insight and planning might not have to be the case. With a dedicated tax team we can provide the advice to help you reduce your tax burden while keeping you on the right side of the rules.

We work with clients to ensure they understand the opportunities open to them and cover off areas of risk that should be managed. Understanding our clients better than anyone else helps us to provide confidence that you’re paying exactly what you need to.

Explore our tax case studies and then let’s talk.

Sleep easy…

- I’m worried my business will run out of cash

- I’m annoyed at the lack of interest from my existing accountant

- I’m worried we’re paying too much tax

- I’m spending too much time IN the business and not enough time ON it

- Who’s going to buy my business?

- I’m not enjoying my business like I used to

- I think we should be more profitable

- I feel lonely in my business

- We don’t have the confidence to take the business to the next level

- The business can’t survive without me

- I’ve set up a new business and need help with the financials

- I feel an overwhelming sense of responsibility for my team

- I don’t know what my business is worth and whether it’s enough for me to retire

- I know we’ve got a great business but can’t seem to make any money!

All SME services

Need some advice? Click here to fill in our enquiry form

Our case studies.

We’re proud of what we do in partnership with our clients. Here are some of the projects we’ve worked on with them.

Tax health check generates £14k savings

We see first hand through due diligence the tax issues which are common among SME’s. These often lead to price chips and can also lead to deals falling over. We managed to catch this issue before it…

See our tax retainer service in action

Too often tax is overlooked, where in reality it is one of the most important factors in maintaining a healthy business operation. Businesses should be regularly reviewing their tax positions not…

£70,000 saving for client

We enjoy finding solutions to our clients' problems, even where it may take several years of hard work to reach a satisfactory outcome. Rather than take the easy solution, which in this VAT…

Katie Hathaway

Bobby Battu

Sarah Clarke-Rae

Jenny Evans

Bhavika Nesbitt

David O’Farrell

Jack Brand

Amie Ellison

Danny Bignell

Yanelisa Mbaba

Aaron Sandhu

It’s all about the people! We work hard to maintain our unique culture and recruit those who share our passion for client service, the value we can add to those around us and our never-ending quest to develop ourselves and our clients.

Tax eNews:

Happy new tax year In this April issue we highlight some of the key tax changes that take effect from the start of the new tax year. Unfortunately, most of the income tax and national insurance thresholds continue to be frozen, resulting in an…

Latest blog:

Get your house in order before seeking finance, and you may not need it! Before looking for capital from external sources, it is paramount to ensure you are already managing cash effectively within your business. If you do end up seeking external…

Download:

KPIs explained

Our KPIs cheat sheet explains some of the technical jargon that may be thrown around and how certain KPIs are calculated.

Latest News:

What’s happening? The ECCTA received Royal Assent in October 2023 and gives more powers to Companies House to play a more significant role in tackling economic crime and supporting economic growth. Introduction of new laws under the ECCTA will be…

Latest blog:

Introduce yourself Hi, I'm Tom and I am a Director in the Corporate Finance Team here at Wilson Partners. I started my career and did my training within audit at EY, and after about 5 years moved into Corporate Finance - which I have been doing ever…

Join the team

Nothing found.

You may also be interested in...

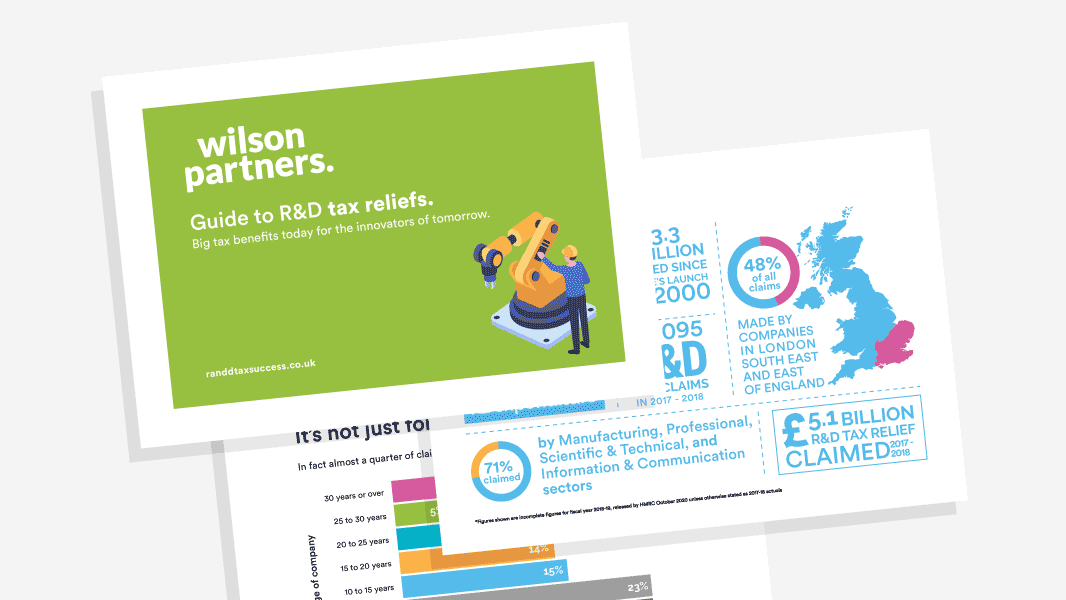

Download our free guide to R&D Tax Reliefs

Big tax benefits today for the innovators of tomorrow.

Tax Planning

We often take on new clients that are worried that they’re paying too much tax or aren’t taking advantage of the opportunities open to them.

5 reasons why you need regular management reporting

One of the most common questions we get from prospects or clients is, ‘why do I need management reporting’? The answers will differ to some degree…