Oliver Gleave, Loop Software

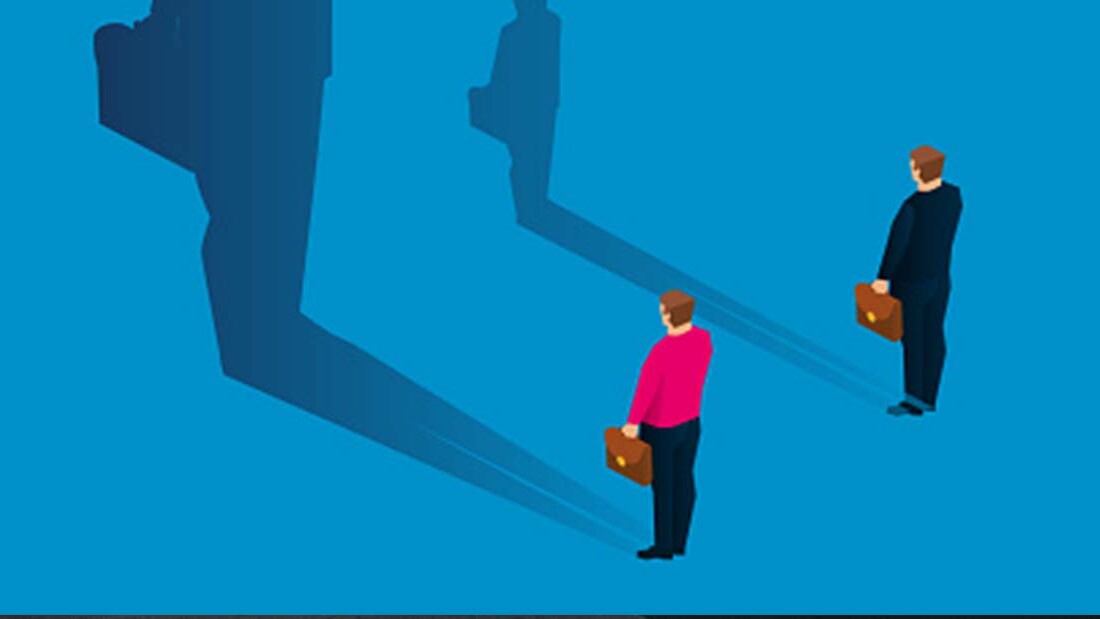

Tax Planning

We often take on new clients that are worried that they’re paying too much tax or aren’t taking advantage of the opportunities open to them. The key to address this is to ensure regular tax planning takes place, especially when circumstances or legislation changes. Planning ahead is vital, as is understanding how the different taxes integrate with one another, especially for owner managed business where it’s important to look at both the corporate and personal tax aspects.

Planning can take the form of an annual cycle, ahead of the tax year end, or for a particular transaction or event.

We also offer a tax retainer package, designed to provide businesses with the certainty and reassurance of regular commercial tax advice to maximise value and minimise risk. We deliver a quarterly review of your tax position, taking account any changing circumstances and offering advice tailored to your individual needs. This ensures you have the information at your fingertips to make well-informed financial decisions throughout the year, mitigating your risk, preventing unforeseen issues and maximising your cash position.

Business Tax

- Overview

- New Year Detax 2024

- Tax planning

- R&D tax credits

- EIS / SEIS

- BAD Relief (formerly Entrepreneurs’ Relief)

- Employee share schemes

- Share reorganisations

- Tax investigations

- Patent Box

- Creative industries & film tax reliefs

- R&D tax relief (SME)

- R&D expenditure credit (RDEC)

- Assistance with HMRC enquiries

- Grant applications

Need some advice? Click here to fill in our enquiry form

Tax eNews:

In this April issue we highlight some of the key tax changes that take effect from the start of the new tax year. Unfortunately, most of the income tax and national insurance thresholds continue to be frozen, resulting in an increasing number of...

Latest blog:

Meet Tom Bradbury Director in the Corporate Finance Team here at Wilson Partners.

Download:

Download our free eBook – The 7 pillars of business success

Read our free guide what you need to focus on to help you make better decisions and achieve your goals quicker.

Latest News:

The ECCTA received Royal Assent in October 2023 and gives more powers to Companies House to play a more significant role in tackling economic crime and supporting economic growth. Introduction of new laws under the ECCTA will be phased in over the…

Latest blog:

Let’s face it, none of us want to think about when we’re going to die, let alone talk about it, or consider if there’s going to be a tax bill waiting for our loved ones once we’re gone. But it’s really important to understand what your Estate is…

Join the team

If you have the energy, mindset and drive to work in an accountancy firm that wants to do things just a little bit differently, then we’d love to hear from you.

Steve Lawrey

Emma Richards

Nick Lloyd

Sara Pedrotti

Gayle Van Niekerk

Jacob Decmar

Sarah Clarke

Bhavika Nesbitt

Declan Cunningham

Anna Tollefson

Kathryn MacPherson

Louise Jones

Rachel Stringer

Khaled Takrouri

Gabrielle Robert

Matthew Shortt

Yanelisa Mbaba

It’s all about the people! We work hard to maintain our unique culture and recruit those who share our passion for client service, the value we can add to those around us and our never-ending quest to develop ourselves and our clients.

You may also be interested in...

Who we are

We are Wilson Partners. We combine the financial expertise, experience and accessibility of our talented team with a deep understanding of our clients to help achieve their goals.

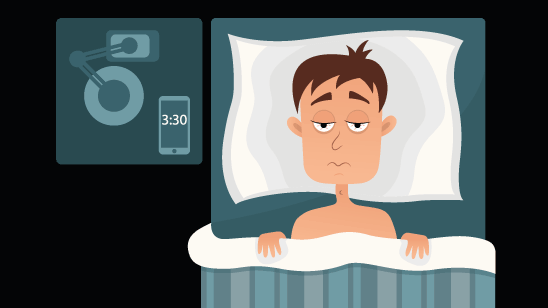

What’s keeping you awake at night?

Running your own business is no mean feat. It can literally become your life and if you’re not careful, that can have you questioning the very reasons you went into business in the first place.

Our aim is to deliver the highest quality content to help existing and aspiring business leaders to reach their goals quicker. Material is generated primarily by our own team of experts.