Over the Rainbow: 3 Pots of Gold to cherish when the rain stops

The pandemic has been a period of unprecedented, unparalleled, and enforced change. However, there is still a lot of change to come; change and opportunity that should be within our gift to grasp and embrace to create a better future.

The new face of professional – embracing the chaos

I have been very lucky with my employer, Wilson Partners Ltd, a relatively young and forward thinking firm, with many working parents among the team and facing similar struggles. This forward thinking approach is prevalent across all areas of the ...

2 things you MUST be aware of if you are taking advantage of the furlough scheme or deferral of VAT

One of the major changes to the furlough scheme when it was extended originally to end of March 2021 and then to end of April 2021, is the publication of information about employers who are claiming under the furlough scheme. As such, employers w...

After the biggest year of change in a generation, is there still room for more change in your business?

'Collaboration' is on the rise, especially among SME's and I've been amazed to see just how much this can benefit businesses at little or no cost. Gone are the days of keeping cards close to your chest, this is the time to open dialogue with busin...

A view on business in 2021

What is also very clear is that entrepreneurs will not wait for the pandemic to end before taking action. Indeed entrepreneurs generally face periods of huge uncertainty with increased enthusiasm for the way ahead. We have seen this manifest itsel...

Furlough scheme updated – Nov 2020

Under the extended scheme, the benefits will return to the same levels as August. The Job Support Scheme, which was scheduled to come in on Sunday 1st November, has been postponed until the furlough scheme ends.

The Job Support Scheme (JSS) starts 1st November

The JSS starts on the 1 November 2020 and runs for 6 months, until 30 April 2021. The government will review the terms of the scheme in January. Employers will be able to claim in arrears from 8 December 2020, with payments made after the claim ha...

It’s time to create a new culture in pursuit of cash excellence

At the start of the COVID-19 crisis, many businesses reacted quickly to stave of the imminent crisis and keep their […]

Winter Economy Plan – Pay as You Grow

Today, 24th September, Chancellor Rishi Sunak announced a new job scheme starting 1 November 2020 to replace the current Job retention (“furlough”) scheme which ends 31 October 2020.

Beware the dangers of recovery

It’s often said, and rightly so, that the most dangerous time for businesses is not going into recession but on the way out. During a recession cash balances and balance sheet reserves often shrink and the return to growth, which usually requires ...

How to apply for a ‘Restart and Recovery’ grant

we’ve created a couple of examples below of what support a client of ours could take advantage of and how best to describe it in the application. In this instance, we’ve referenced advice specific to cashflow to help future proof your business and...

The Government’s Restart and Recovery Grant scheme starts next week

From next Tuesday, 14th September, the Government’s Restart and Recovery SME Grants are open for application and you can apply for up to £3k for your business. The Government has made £20m of funding available to boost small businesses recovery fr...

Flexible furlough scheme update for September 2020

The latest statistics show over 9.6 million employees have been on Furlough since March and currently there are 1.2 million Furloughed in August. This amounts to over £34.7billion in grants from the Coronavirus Job Retention scheme which ends in O...

HMRC has published additional information on the job retention bonus

Employers will be able to claim a one-off payment of £1,000 for every employee they have previously received a grant for under the Coronavirus Job Retention Scheme (CJRS), and who remains continuously employed through to the end of January 2021.

No false hope in Sunak’s summer update

There was also a huge shot in the arm for the housing market with a temporary a cut in stamp duty which will leave 90% of house purchases tax free. Other tax cuts included a reduction in vat to just 5% aimed at the food, accommodation and attracti...

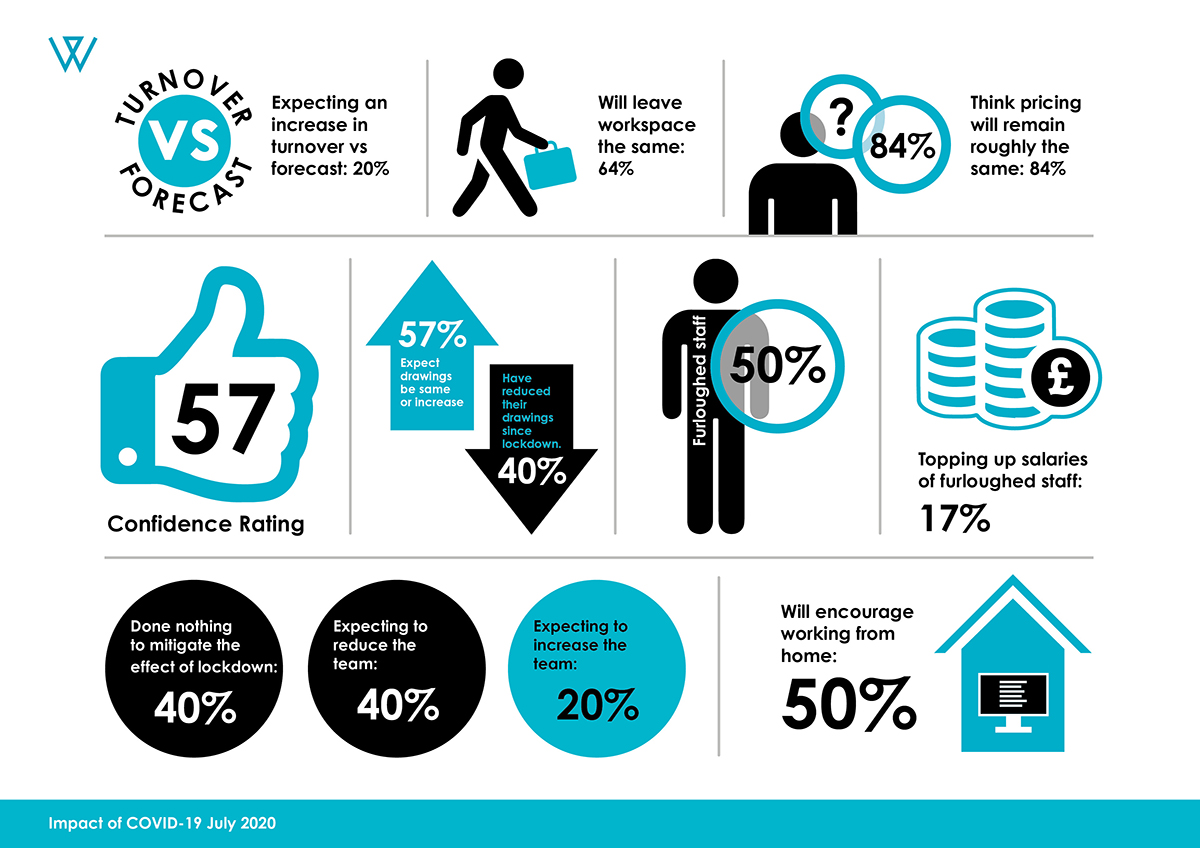

Research report: Business in the Thames Valley in the midst of COVID-19

Well, unsurprisingly COVID-19 and the lockdown measures have had a polarising effect across business. Whilst some have seen their sales fall off a cliff due to exposure to certain sectors such as retail or hospitality, others with exposure to more...

MORE FIRMS CAN NOW BENEFIT FROM THE FUTURE FUND

More start-ups and innovative firms will be able to apply for investment from the government’s Future Fund from 30 June: […]

Welcome news for beer drinkers (and the hospitality sector)

There was welcome news on Tuesday 23rd June for the English hospitality sector and, if they can operate safely, they […]

Is diversification your route to continued success?

With many small businesses experiencing uncertainty, not to mention financial difficulties, many are looking at how they can adapt their […]

FLEXIBLE FURLOUGH IS COMING – BE PREPARED!

The Government, has confirmed further changes to the Coronavirus Job Retention Scheme (CJRS) with the introduction of flexible furloughing as well as the increased costs to employers, from 1 August, who have furloughed employees. Whilst it is wit...

PARENTS RETURNING TO WORK AFTER EXTENDED LEAVE ELIGIBLE FOR FURLOUGH

People on paternity and maternity leave who return to work in the coming months will be eligible for the government’s […]

APPLY FOR THE CORONAVIRUS LOCAL AUTHORITY DISCRETIONARY GRANTS FUND – ENGLAND

The Discretionary Grant Fund supports small and micro businesses that are not eligible for other grant schemes opened on the […]

It’s time to think like a start-up and act like a grown up – you need to be on top of your game to trade through the COVID-19 crisis

Beware also that as you trade through this, often the most dangerous time for a businesses is coming out of recession. Growth inevitably eats cash and so the funding of your business to allow that growth will be vitally important – especially if b...

Government Furlough Scheme Extended By Four Months

The changes to the current scheme will become clearer in the days and weeks ahead, but following a series of tweetson Rishi Sunak's account this afternoon, what we can tell so far is that the extension to the scheme is designed to offer flexibilit...

Avoid relaxing your IT Security to enable working from home during the COVID-19 crisis

In mid-March, a frantic scramble ensued to equip office-based workforces in so many different businesses with the ability to work from home, as it was either this or no business at all. Everything happened in a blur, and accordingly many processe...

Should you consider cocooning your business during the COVID-19 crisis?

If your business has seen a huge drop in revenues in recent weeks due to the COVID-19 crisis, we’ve produced this blog to give you an idea of what cocooning (or mothballing) a business might look like and why and how you might do it in response to...

Our tips for keeping your head through the Coronavirus crisis

It’s now almost 3 weeks since Boris Johnson began his daily press briefings and Rishi Sunak unveiled the first raft […]

The Coronavirus Job Retention Scheme ***UPDATED 17th APRIL 2020***

The Coronavirus Job Retention Scheme is a temporary scheme open to all UK employers for at least three months starting […]

Don’t feel isolated – 10 considerations for your business in the wake of Coronavirus (Covid-19)

Be aware of your responsibilities as a director. If you’re looking at a period where losses may be made and the long term viability of the business could be in doubt you will have to remember your responsibilities and duties as a director. It ma...

Huge support for UK plc: COVID-19. What action should you take NOW? ***UPDATED 27th APRIL 2020***

Coronavirus Job Retention Scheme Under the Coronavirus Job Retention Scheme, all UK employers will be able to access support to […]