The benefits of benchmarking for SaaS businesses

Attracting investment into SaaS businesses, transitioning business models in SaaS and investing into SaaS business is something Wilson Partners has been working on enthusiastically with clients and management teams over the last few years. In the last 18 months alone we have worked on 17 SaaS investments, almost one a month!

Our transactions span many different sub-sectors, including edtech, medtech, martech, proptech to name a few and within this we have had incredible opportunities to work with specialist Investors such as Octopus Ventures, Ideagen and Clearcourse as well as the entrepreneurial businesses that they have backed. Details of these can be found here.

In a previous blog I wrote about the attributes that make a solid SaaS investment opportunity: Building on this, I am keen to share some benchmarking data that we have collated from our deals to illustrate the points from my previous blog. Not quite big data just yet, but watch this space…we’re on a mission!

Wilson Partners Benchmarking

ARR Annual Recurring Revenue

A key metric used by SaaS or subscription businesses that have term subscription agreements, meaning there is a defined contract length.

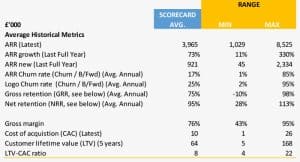

The deals Wilson Partners have been involved in are a mixture of growth capital investments and acquisitions, with an avg. ARR value of £4m. The average ARR growth rate across these companies is 73%, with almost £1m of new ARR being added in the latest financial year.

Churn

Churn is the percentage rate at which SaaS customers fail to renew their recurring revenue subscriptions, either in value (ARR) or volume (Logo) terms.

Churn rates are variable, often reflecting churn of a smaller, longer tail of customers, as a company develops and scales its proposition towards larger Enterprise customers. Average ARR churn rates (ARR churn / brought forward ARR) are coming in at 17%, compared with logo churn rates (logo churn / brought forward logos) of 24%, indicating that overall these companies are churning lower value clients.

We would expect these churn rates to be reducing over time as products mature, with churn rates <10% a decent target to aim for.

Retention

Retention is a key metric that measures the percentage of value a business retains from existing customers over a period. Ideally, a high retention rate indicates a low churn rate.

Customer retention is key. There is little point is driving hard at new customer acquisition if existing customers are falling away due to a lack of focus. The best SaaS businesses we see have a razor focus on client account management and customer success to drive strong retention.

In terms of our benchmarking, gross retention rates (brought forward ARR less churn less down sell / brought forward ARR) averaged 75%, with net retention rates (brought forward ARR less churn less down sell plus upsell / brought forward ARR) coming in at 95%. This means that a typical SaaS business is needing to find 25% New ARR and Upsell (to existing clients) before it can deliver growth, or after considering the average Upsell, a further 5% is required from New ARR before companies are into growth. If you can get net retention above 100% then every new customer you win is pure top-line growth and if new customer acquisition slows down you will still be growing!

Margin

Margin is the measure of gross profit (revenue less direct costs) divided by revenue and indicates how much £ profit can be derived from every £ incremental of revenue.

Gross margin across our dataset averaged 76%, with a wide range between 43% and 95%. Part of this is due to differing allocations of cost but also may reflect the level of maturity or scale of the SaaS proposition. A fully scaled SaaS business model should be towards the top-end of this range, with the only direct servicing costs related to hosting.

CAC and LTV

The LTV/CAC ratio compares the value of a customer over their lifetime to the cost of acquiring them.

The Cost of Acquiring Customers (“CAC”) is widely variable ranging from less than £1k to £26k, which will be dependent on the product value and the potential Lifetime Value (“LTV”) of the customers being acquired; in our dataset this ranges from £5k to £168k assuming a 5-year lifetime for a typical customer.

This gives LTV-CAC ratios of between 4 and 22, with an average of 8. As a generalisation, if the LTV/CAC ratio is less than 1.0, the company is destroying value, and if the ratio is greater than 1.0, it may be creating value. A ratio greater than 3.0 is considered “good,” but that’s not necessarily the case; a ratio that is too high could indicate that a company is not spending enough on customer acquisition and is missing out on market share. In most companies that we look at, there is opportunity to refine a strategic marketing plan to optimise CAC and increase customer acquisition to fuel further growth.

Rule of 40

We have not looked at the Rule of 40 in this analysis. The Rule of 40 provides a high-level view of a SaaS business’s health. Put simply, if percentages of growth rate and profit margin total at least 40 when added together, then a business is in great health and could double in valuation. However, the rule of 40 is generally not relevant for our deals as we are dealing with scale up SaaS and this metric is designed to assess performance of SaaS businesses that are already at scale.

If you would like to talk to us about attracting investment into your SaaS business, transitioning your business model from traditional consultancy to SaaS, or about investing in SaaS business then please get in touch with Dan James to arrange an informal chat.

Click here to learn more about our work in the software sector.

Event

Webinar – Changes to the UK Trust Registration Service, May ’22

A short webinar and Q&A session with our Trust specialists Jodie Green and Sara Pedrotti. You can view the video and download the presentation here.

Download our free guide to the 7 pillars of business success

Read our free guide what you need to focus on to help you make better decisions and achieve your goals quicker.

Please complete our form to download the guide.

Sign up to receive alerts

Call us on 01628 770 770 for a no-obligation chat

You may also be interested in...

Meet the team in 90 seconds – Lesley Kibble

Introduce yourself Hi, I'm Lesley, outside of work I love to travel with my partner Lee and visit new places. I recently returned from Krakow, Poland…

Seeking investment: Getting your business fit for investment

Get your house in order before seeking finance, and you may not need it! Before looking for capital from external sources, it is paramount to ensure…

Meet the team in 90 seconds – Tom Bradbury

Introduce yourself Hi, I'm Tom and I am a Director in the Corporate Finance Team here at Wilson Partners. I started my career and did my training…