Research report: Business in the Thames Valley in the midst of COVID-19

At Wilson Partners, we recently conducted some research to gauge the impact the COVID-19 measures have had on our client base since they were introduced in March 2020. Our client base consists of approx. 500 ambitious, owner managed businesses, largely SMEs, headquartered in the Thames Valley with 5 to 150 employees. We’ve set out to understand what action businesses have taken, intend to take and how they see the year ahead.

What did we learn?

Well, unsurprisingly COVID-19 and the lockdown measures have had a polarising effect across business. Whilst some have seen their sales fall off a cliff due to exposure to certain sectors such as retail or hospitality, others with exposure to more buoyant sectors have seen their sales increase. We also know, talking to a number of clients, that quick reactions meant they were able to shift their market focus and have been able to maintain, or even grow, turnover in completely new markets. The coming months are crucial in determining what the longer term prospects look like for businesses. Careful planning and some difficult decisions will be needed over the coming months, particularly with the Government’s support for the Coronavirus Job Retention Scheme scheduled to finish at the end of October.

Having the right financial information, and looking at different scenarios, is critical to ensure businesses are empowered to make informed decisions and maximise their chances of accelerating out of the crisis. The avoidance of a second wave and a return to tighter lockdown restrictions will be critical for the medium and long-term impact on the economy at large. Whilst survival is top of the agenda for many businesses, it would appear to be the year of the hustler.

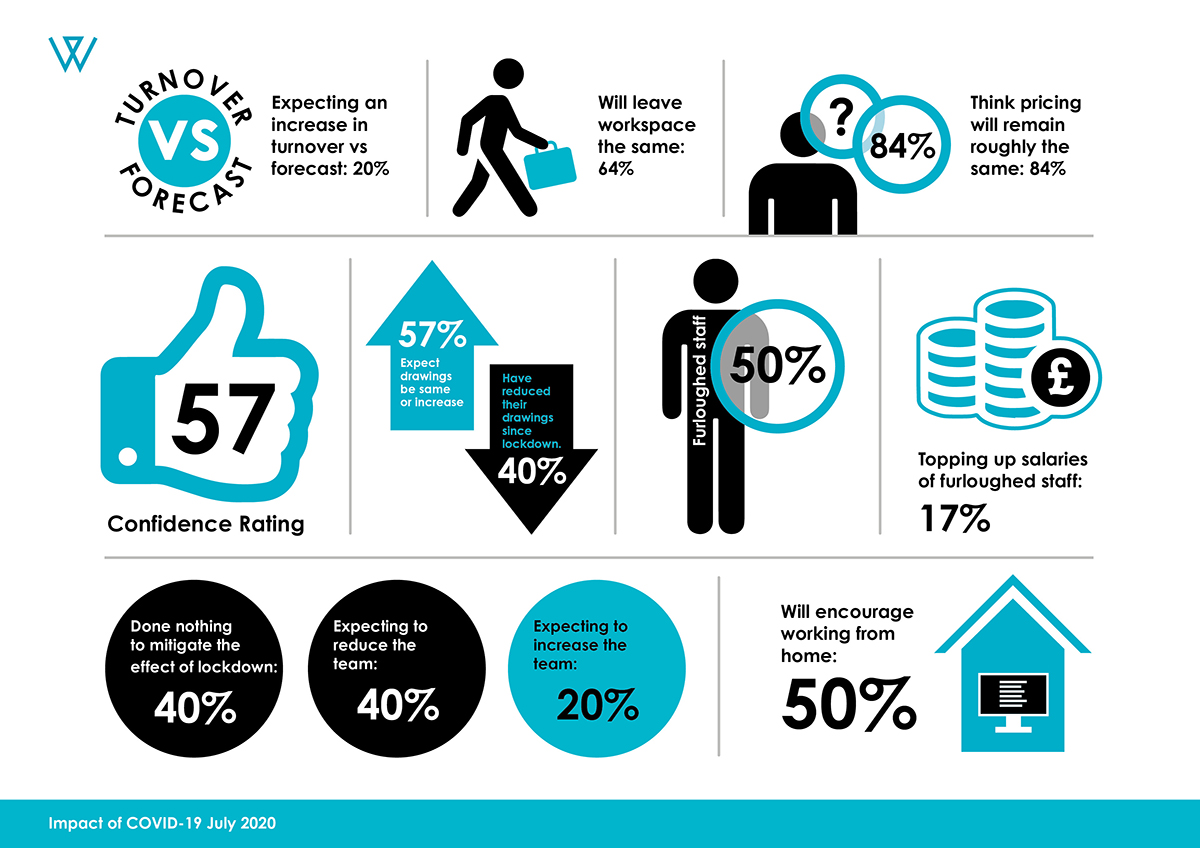

The stand out numbers

As mentioned earlier COVID-19 has had a polarising effect, whilst with all economic crises there comes opportunity it’s evident in the range of the confidence rating between 22 and 100 just how fragmented business has been. On balance, the overall confidence rating of 57 is probably not unrealistic. Clearly businesses have been conserving cash, given that 40% of respondents expect turnover to be the same or increase, 60% have taken a pay cut. That looks like good housekeeping in order to protect cash through turbulent times..

50% have furloughed staff, whilst 40% are not expecting their payroll to look any different.

All this information and more is in our report, which you can download here.

Helping our clients make rational, measured decisions with clearly articulated information has been at the heart of our own response and we continue to be here for those clients who need us. We hope that the data in our latest research is a useful addition to your planning for the weeks and months ahead.

Event

Webinar – Changes to the UK Trust Registration Service, May ’22

A short webinar and Q&A session with our Trust specialists Jodie Green and Sara Pedrotti. You can view the video and download the presentation here.

Download our free guide to the 7 pillars of business success

Read our free guide what you need to focus on to help you make better decisions and achieve your goals quicker.

Please complete our form to download the guide.

Sign up to receive alerts

Call us on 01628 770 770 for a no-obligation chat

You may also be interested in...

Your tax allowances for 2024/25

With the new tax year in full swing, make sure you're aware of the tax allowances for 2024/2025! Pension annual allowance The pension allowance…

Meet the team in 90 seconds – Lesley Kibble

Introduce yourself Hi, I'm Lesley, outside of work I love to travel with my partner Lee and visit new places. I recently returned from Krakow, Poland…

Seeking investment: What a Private Equity investor looks for

What a Private Equity investor looks for Private equity investment is a fundamental source of business funding that plays a pivotal role in…