Business Tax

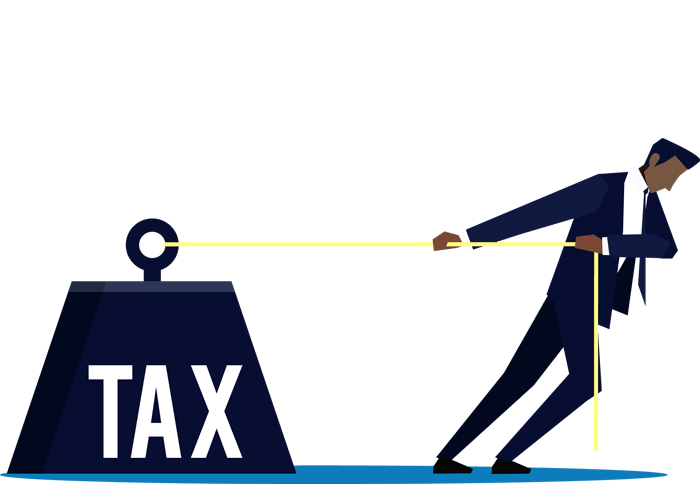

When it comes to tax, you don’t know what you don’t know and it’s no surprise. With over 10 million words and 22,000 pages of small print, coupled with the vast volumes of case law and guidance, tax law is a complex beast. Luckily for you, we’re all over it! With a dedicated team of some of the brightest experts on offer, we can provide the advice to help you reduce your tax burden whilst keeping you on the right side of the rules. That’s why we’re the top choice for Maidenhead, Cambridge and Sevenoaks Tax Advisors for businesses and private individuals.

In the lifecycle of your business you will likely be paying tax through multiple ‘collection points’, from PAYE Income Tax, Personal Tax Returns, VAT, S455, Corporation Tax, BAD Relief (formerly Entrepreneurs’ relief) – you get the picture it’s a minefield. And that’s before you’ve even thought about getting rewarded for innovations with the likes of R&D Tax Incentives, The Patent Box etc.

Tax is business critical so ensuring you are set up correctly to be paying the right amount of tax and not exposing yourself to potential nasty surprises can be the difference between the success and failure of a business. So, when you’re in business, you need to know have the right team in place to ensure your business is in the best position at all times.

At Wilson Partners, we have a dedicated tax team which covers Corporate Tax, Innovations and Personal Tax so we can cover all bases and we’re commercially minded too, so we get the bigger picture.

Tax FAQs:

Deciding whether you need an accountant to help with your tax return comes down to how much work is required and how confident you are with tax legislation. It’s also worth putting a value on your own time and weighing up whether that time is better spent on your business and what value you put on peace of mind knowing that your return has been submitted by a professional.

HMRC have increased the number of tax enquiries, with most enquiries now generated by computer “risk profiling” while other are selected at random. Even if you have done nothing wrong, you are still at risk of being enquired. The enquiries are extremely detailed and HMRC will try hard to and errors. You can read more about tax investigations here.

In short, tax investigations are on the rise. Having massively boosted their workforce, HMRC are on a drive to recoup unpaid taxes which means they are casting the net wider. In the event that you are subject to an investigation, any fees incurred by us (assuming you have not broken the law) should be covered.

The deadline for submitting your Self Assessment tax return is 31st January and any tax liability is due to be paid the same day. Depending on your circumstances, you are likely to need to make a ‘payment on account’ on 31st July in the same year.

‘Payments on account’ are advance payments towards your tax bill (including Class 4 National Insurance if you’re self-employed).

The current UK VAT registration threshold stands at £85,000. The government has stated that this threshold will remain unchanged until 2024.

Once your business’s turnover reaches the VAT threshold, you have 30 days to register for VAT with HMRC. Once you’re registered, your business has a new range of responsibilities including:

- Charging VAT on your products or services

- Paying VAT on the goods or services supplied by your suppliers

- Submitting your VAT return to HMRC

- Maintaining a VAT account and records

BIK stands for Benefit in Kind, and this covers certain fringe benefits given by employers which are not included in the employee’s salary. Typical examples include company cars, private medical insurance, child car vouchers etc.

There are many factors to consider when taking the option to have a company car and there are plenty of arguments for and against. However, with the tax rates on company cars weighted towards favouring low emissions, there is a big case in favour of having an electric car as a company car.

When buying a car through your company, your are subject to tax based on the benefit in kind (BIK) which varies according to the price of the car and it’s emissions. The government currently (tax year 23/24) offers very favourable tax rates for fully electric vehicles purchased through a company car scheme and so this can be a cost effective way of buying or leasing a car. Read more here.

Our business tax services

- Overview

- New Year Detax 2024

- Tax planning

- R&D tax credits

- EIS / SEIS

- BAD Relief (formerly Entrepreneurs’ Relief)

- Employee share schemes

- Share reorganisations

- Tax investigations

- Patent Box

- Creative industries & film tax reliefs

- R&D tax relief (SME)

- R&D expenditure credit (RDEC)

- Assistance with HMRC enquiries

- Grant applications

You may also be interested in...

Download our free guide to R&D Tax Reliefs

Big tax benefits today for the innovators of tomorrow.

Tax Planning

We often take on new clients that are worried that they’re paying too much tax or aren’t taking advantage of the opportunities open to them.

5 reasons why you need regular management reporting

One of the most common questions we get from prospects or clients is, ‘why do I need management reporting’? The answers will differ to some degree…

Need some advice? Click here to fill in our enquiry form

Tax eNews:

In this April issue we highlight some of the key tax changes that take effect from the start of the new tax year. Unfortunately, most of the income tax and national insurance thresholds continue to be frozen, resulting in an increasing number of...

Latest blog:

Meet Lesley, our Office Manager at the Cambridge office.

Download:

Download our free eBook – The 7 pillars of business success

Read our free guide what you need to focus on to help you make better decisions and achieve your goals quicker.

Latest News:

The ECCTA received Royal Assent in October 2023 and gives more powers to Companies House to play a more significant role in tackling economic crime and supporting economic growth. Introduction of new laws under the ECCTA will be phased in over the…

Latest blog:

It all starts with ‘cash-flow’. Review (regularly) what’s coming in, what’s going out in order to optimise your cash position, particularly in a growing businesses where spend can quickly spiral out of control, unless monitored closely. You need to…

Join the team

If you have the energy, mindset and drive to work in an accountancy firm that wants to do things just a little bit differently, then we’d love to hear from you.

Steve Lawrey

Emma Richards

Nick Lloyd

Sara Pedrotti

Gayle Van Niekerk

Jacob Decmar

Sarah Clarke-Rae

Bhavika Nesbitt

Declan Cunningham

Anna Tollefson

Kathryn MacPherson

Louise Jones

Rachel Stringer

Khaled Takrouri

Gabrielle Robert

Matthew Shortt

Yanelisa Mbaba

It’s all about the people! We work hard to maintain our unique culture and recruit those who share our passion for client service, the value we can add to those around us and our never-ending quest to develop ourselves and our clients.