Beware the dangers of recovery

It’s often said, and rightly so, that the most dangerous time for businesses is not going into recession but on the way out. During a recession cash balances and balance sheet reserves often shrink and the return to growth, which usually requires ...

How to apply for a ‘Restart and Recovery’ grant

we’ve created a couple of examples below of what support a client of ours could take advantage of and how best to describe it in the application. In this instance, we’ve referenced advice specific to cashflow to help future proof your business and...

The Government’s Restart and Recovery Grant scheme starts next week

From next Tuesday, 14th September, the Government’s Restart and Recovery SME Grants are open for application and you can apply for up to £3k for your business. The Government has made £20m of funding available to boost small businesses recovery fr...

Flexible furlough scheme update for September 2020

The latest statistics show over 9.6 million employees have been on Furlough since March and currently there are 1.2 million Furloughed in August. This amounts to over £34.7billion in grants from the Coronavirus Job Retention scheme which ends in O...

HMRC has published additional information on the job retention bonus

Employers will be able to claim a one-off payment of £1,000 for every employee they have previously received a grant for under the Coronavirus Job Retention Scheme (CJRS), and who remains continuously employed through to the end of January 2021.

7 Pillars of success – Part 7, Sales

And finally, make sure your team completely understands your product or service and are prepared to put in the effort to do their homework and understand the prospect as well.

No false hope in Sunak’s summer update

There was also a huge shot in the arm for the housing market with a temporary a cut in stamp duty which will leave 90% of house purchases tax free. Other tax cuts included a reduction in vat to just 5% aimed at the food, accommodation and attracti...

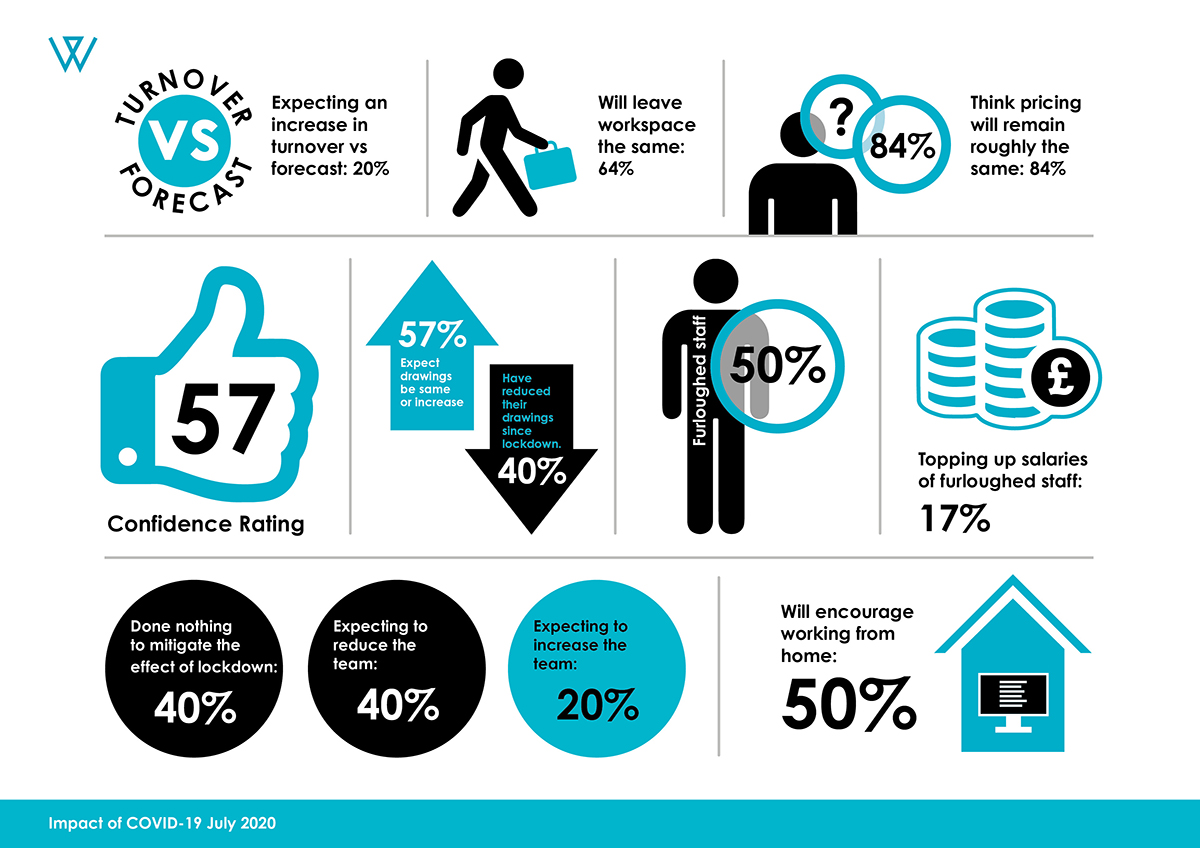

Research report: Business in the Thames Valley in the midst of COVID-19

Well, unsurprisingly COVID-19 and the lockdown measures have had a polarising effect across business. Whilst some have seen their sales fall off a cliff due to exposure to certain sectors such as retail or hospitality, others with exposure to more...

MORE FIRMS CAN NOW BENEFIT FROM THE FUTURE FUND

More start-ups and innovative firms will be able to apply for investment from the government’s Future Fund from 30 June: […]

Welcome news for beer drinkers (and the hospitality sector)

There was welcome news on Tuesday 23rd June for the English hospitality sector and, if they can operate safely, they […]

Is diversification your route to continued success?

With many small businesses experiencing uncertainty, not to mention financial difficulties, many are looking at how they can adapt their […]

FLEXIBLE FURLOUGH IS COMING – BE PREPARED!

The Government, has confirmed further changes to the Coronavirus Job Retention Scheme (CJRS) with the introduction of flexible furloughing as well as the increased costs to employers, from 1 August, who have furloughed employees. Whilst it is wit...