R&D tax credits

Research and Development (R&D) tax reliefs, or R&D tax credits as they are also referred, are government tax reliefs rewarding UK companies for investing in innovation and can have a valuable impact on small and large businesses alike. The government has set aside billions of pounds for claims over the coming years and the definition of qualifying companies is wider than you might expect – and definitely not the preserve of the scientists in white coats.

Businesses spending money on creating or appreciably improving existing products, services or processes which incorporate or represent an increase in overall knowledge or capability in a field of science or technology could be eligible for a sizeable reduction in their Corporation Tax and / or a cash payment to reward their investment. Relief for SME’s is currently equivalent to between 21.5p and 18.6p for every £1 of qualifying expenditure depending on profitability.

Business Tax

- Overview

- New Year Detax 2024

- Tax planning

- R&D tax credits

- EIS / SEIS

- BAD Relief (formerly Entrepreneurs’ Relief)

- Employee share schemes

- Share reorganisations

- Tax investigations

- Patent Box

- Creative industries & film tax reliefs

- R&D tax relief (SME)

- R&D expenditure credit (RDEC)

- Assistance with HMRC enquiries

- Grant applications

You may also be interested in...

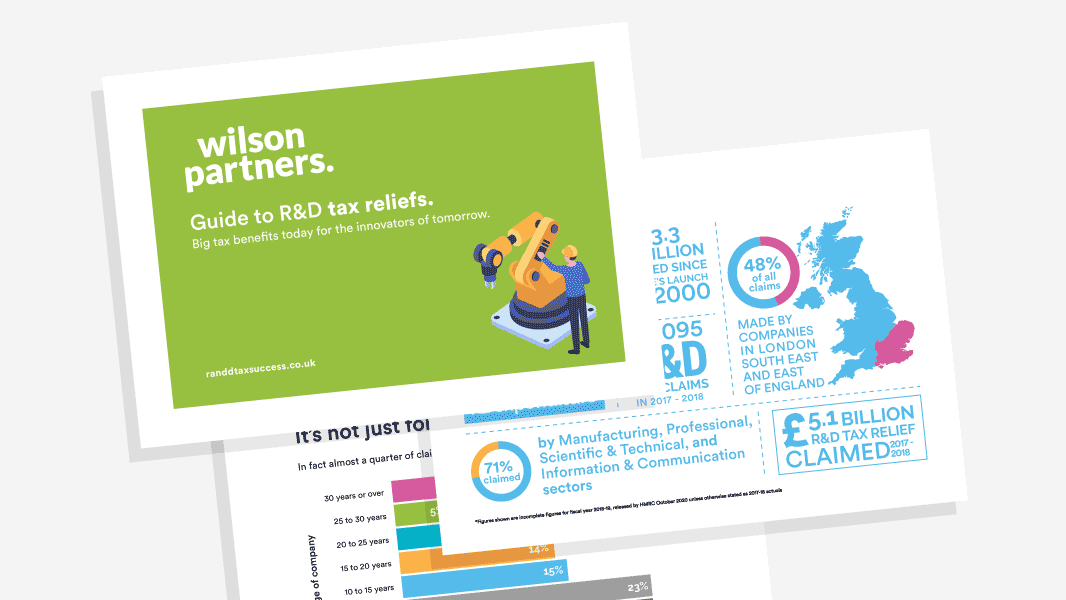

Download our free guide to R&D Tax Reliefs

Big tax benefits today for the innovators of tomorrow.

Tax Planning

We often take on new clients that are worried that they’re paying too much tax or aren’t taking advantage of the opportunities open to them.

5 reasons why you need regular management reporting

One of the most common questions we get from prospects or clients is, ‘why do I need management reporting’? The answers will differ to some degree…

Need some advice? Click here to fill in our enquiry form

Tax eNews:

In this April issue we highlight some of the key tax changes that take effect from the start of the new tax year. Unfortunately, most of the income tax and national insurance thresholds continue to be frozen, resulting in an increasing number of...

Latest blog:

Meet Lesley, our Office Manager at the Cambridge office.

Download:

Download our free eBook – The 7 pillars of business success

Read our free guide what you need to focus on to help you make better decisions and achieve your goals quicker.

Latest News:

The ECCTA received Royal Assent in October 2023 and gives more powers to Companies House to play a more significant role in tackling economic crime and supporting economic growth. Introduction of new laws under the ECCTA will be phased in over the…

Latest blog:

It all starts with ‘cash-flow’. Review (regularly) what’s coming in, what’s going out in order to optimise your cash position, particularly in a growing businesses where spend can quickly spiral out of control, unless monitored closely. You need to…

Join the team

If you have the energy, mindset and drive to work in an accountancy firm that wants to do things just a little bit differently, then we’d love to hear from you.

Katie Hathaway

Bobby Battu

Sarah Clarke-Rae

Jenny Evans

Bhavika Nesbitt

David O’Farrell

Jack Brand

Amie Ellison

Danny Bignell

Yanelisa Mbaba

Aaron Sandhu

It’s all about the people! We work hard to maintain our unique culture and recruit those who share our passion for client service, the value we can add to those around us and our never-ending quest to develop ourselves and our clients.