Tax Consultancy

R&D tax reliefs explained

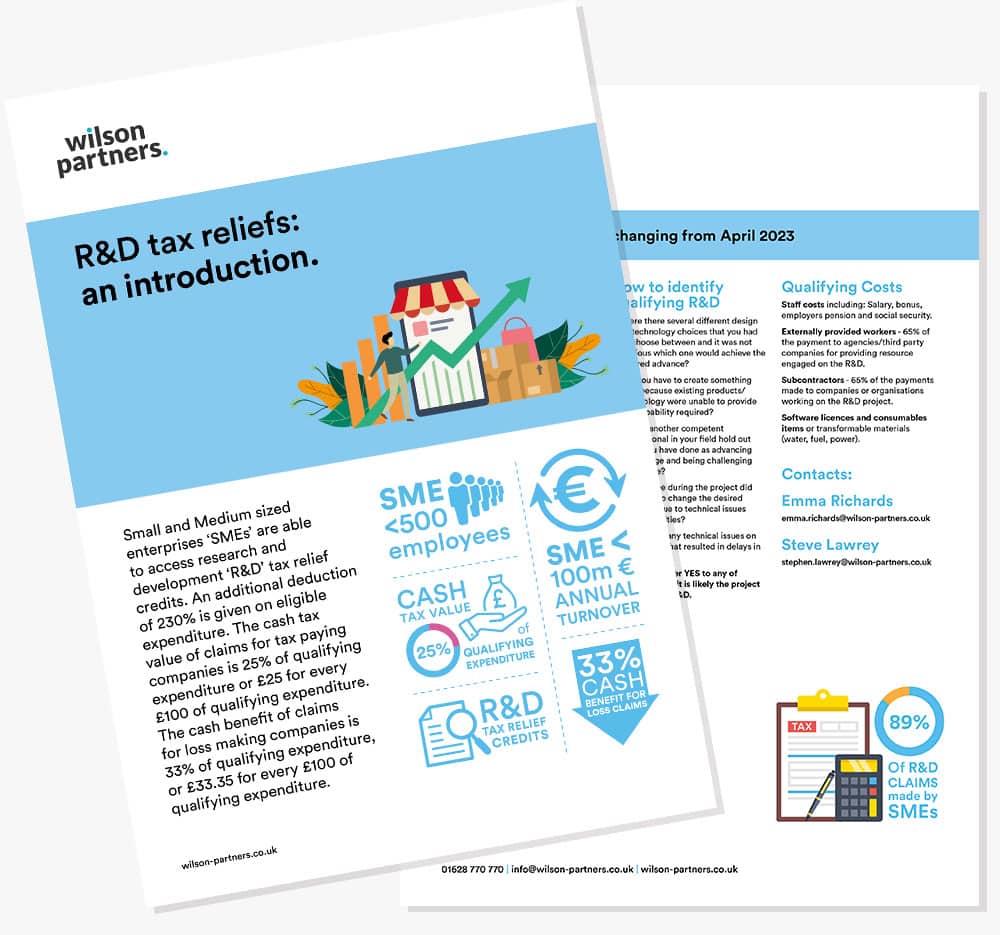

Research and Development (R&D) tax reliefs, or R&D tax credits as they are also referred, are government tax reliefs rewarding UK companies for investing in innovation and can have a valuable impact on small and large businesses alike. The government has set aside billions of pounds for claims over the coming years and the definition of qualifying companies is wider than you might expect – and definitely not the preserve of the scientists in white coats.

Businesses spending money on creating or appreciably improving existing products, services or processes which incorporate or represent an increase in overall knowledge or capability in a field of science or technology could be eligible for a sizeable reduction in their Corporation Tax and / or a cash payment to reward their investment. Relief for SME’s is currently equivalent to between 21.5p and 18.6p for every £1 of qualifying expenditure depending on profitability.

Need some advice? Click here to fill in our enquiry form

See how much relief you could receive using our calculator for SMEs

Most companies, including start-ups, fall into the SME category and can claim back up to 21.5p for every pound spent on R&D. Even if your business is loss-making you could receive a cash benefit. See how much you could potentially claim in our calculator below, simply select whether you’re profit or loss-making and select the amount of R&D investment – you could be pleasantly surprised.

Find out what you might be eligible for using our simple calculator below.

Please note our calculations are based on the rates for R&D activity taking place from 1st April 2023

Your company's financial position:

- Making a profit?

- Making a loss?

Annual R&D spend:

- £50,000

- £250,000

- £500,000

- £1,000,000

- £50,000

- £250,000

- £500,000

- £1,000,000

*To qualify as R&D Intensive more than 40% of business expenditure must be on R&D, changing to 30% from 1st April 2024.

Is my business eligible?

When putting together an R&D tax credit claim, we look for the following types of R&D expenditure to assess whether they qualify:

- Expenditure on staff including salaries, employer’s NIC and pension contributions.

- Expenditure on subcontractors and freelancers.

- Expenditure on materials and consumables including heat, light and power that are used up or transformed by the R&D process.

- Expenditure on some types of software.

R&D FAQs?

A government backed tax incentive scheme whereby companies can receive benefit for expenditure on developing new products, services and processes.

The tax definition very different from the accounting definition and is much broader. The government define R&D for tax purposes as work carried out that seeks to achieve an advancement in science or technology where the chance of success is uncertain.

As you would expect, highly technical projects qualify for R&D tax credits but due to the broad definition, qualifying projects can also be as simple as merging two IT systems or improving a production process. So it’s important to review all projects.

Businesses spending money on creating or appreciably improving existing products, services or processes which incorporate or represent an increase in overall knowledge or capability in a field of science or technology could be eligible for a sizeable reduction in their Corporation Tax and / or a cash payment to reward their investment. Relief for SME’s is currently equivalent to between 21.5p and 18.6p for every £1 of qualifying expenditure depending on profitability.

Employee and subcontractor costs generally make up the majority of an R&D claim. Certain consumables and a portion of admin costs can also sometimes be included. It is important that staff time spent on projects is recorded accurately to increase the robustness of the claim.

Companies have up to two years after the year end to make a claim.

We can work with your technical teams to identify the qualifying work carried out by the company, and then work with the finance team to identify the costs and make sure we maximise the consumables and indirect costs.

You may also be interested in...

Who we are

We are Wilson Partners. We combine the financial expertise, experience and accessibility of our talented team with a deep understanding of our clients to help achieve their goals.

What’s keeping you awake at night?

Running your own business is no mean feat. It can literally become your life and if you’re not careful, that can have you questioning the very reasons you went into business in the first place.

Our aim is to deliver the highest quality content to help existing and aspiring business leaders to reach their goals quicker. Material is generated primarily by our own team of experts.

Anthony Francis, Pelican Capital