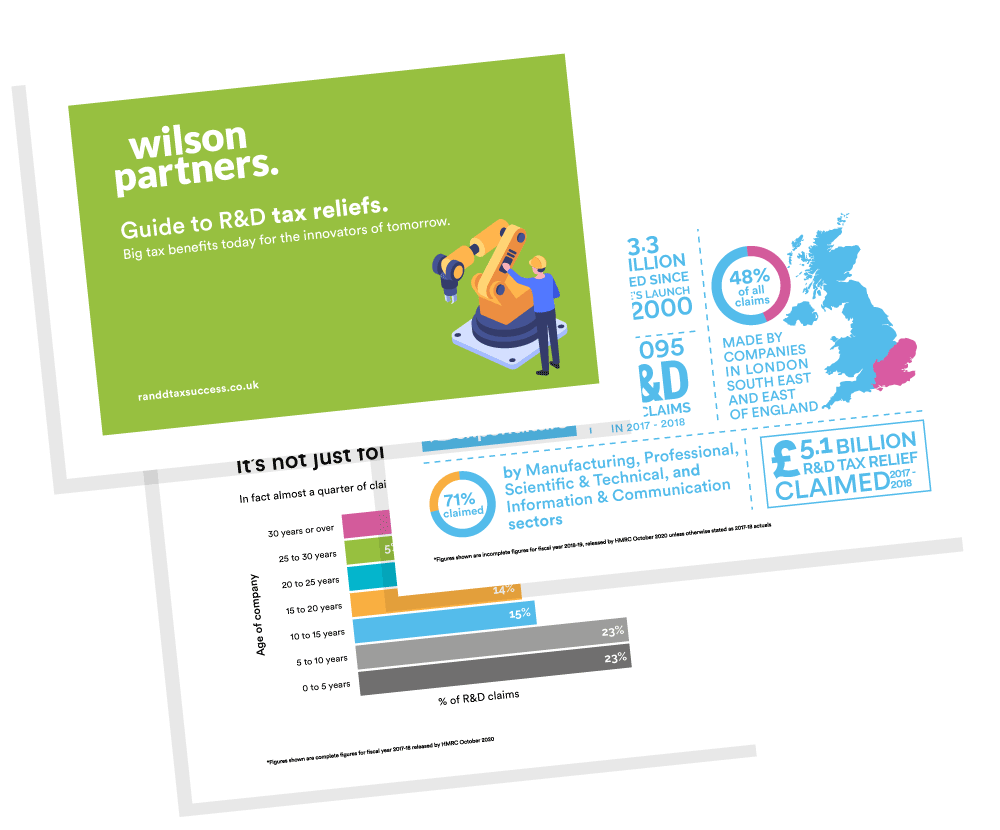

Tax Consultancy - R&D Tax Credits

R&D Tax Reliefs for Businesses in Maidenhead

Wilson Partners are an award-winning accountancy and tax advisory firm with significant R&D tax credit expertise. Based in the centre of Maidenhead, they should be the first choice option for any Maidenhead business looking to outsource their accountancy or to maximise their R&D tax credit relief.

With extensive travel links and in close proximity to the largest industrial estate in Europe, Maidenhead should be a hub of business innovation. Most choose not to do this as they fear being unable to recoup the significant investments involved. Wilson Partners is here to change that – with expert Maidenhead tax credit advice.

To encourage businesses in Maidenhead and across the UK, the Government has introduced tax relief in the form of Research and Development (R&D) tax credits. Available to small, medium and large organisations, they are a chance for almost any industry to benefit from the billions set aside for future R&D claims.

Some potential avenues for innovation are creating a new product, service or process, upgrading an existing service or enhancing an existing internal or external system. From 1 April 2023 the credits themselves can have a reduction of up to 21.5p per £1 invested, depending on the company’s profit/loss position and up to 27p per £1 can be claimed on qualifying expenditure for R&D intensive businesses. Maidenhead tax credits would be revolutionary for any business, but how do you claim it?

Need some advice? Click here to fill in our enquiry form

See how much relief you could receive using our calculator for SMEs

We’re proud to help out tax credit claims for Maidenhead businesses every year.

From £10,000 to over £400,000, there is no telling how much you are missing out on for R&D tax credit claims, meaning that there is no reason to delay investigating whether your Maidenhead business is eligible for R&D Tax Credits.

Wilson Partners are delighted to help with every claim and we’ll work with your technical teams to establish what qualifying work can be identified and co-operate with your finance teams to identify the costs so you can reap the best possible financial rewards.

We tend to operate on a no-win no fee basis, so you have peace of mind that you don’t lose out on anything by simply investigating the possibility. R&D tax relief is a major boost for Maidenhead businesses.

There’s no reason to not explore R&D tax relief, so if you are a Maidenhead business, contact Wilson Partners today and start to get the best rewards for your innovation.

Find out what you might be eligible for using our simple calculator below.

Please note our calculations are based on the rates for R&D activity taking place from 1st April 2023

Your company's financial position:

- Making a profit?

- Making a loss?

Annual R&D spend:

- £50,000

- £250,000

- £500,000

- £1,000,000

- £50,000

- £250,000

- £500,000

- £1,000,000

*To qualify as R&D Intensive more than 40% of business expenditure must be on R&D, changing to 30% from 1st April 2024.

R&D FAQs?

When putting together an R&D tax credit claim for a Maidenhead business, we look for the following types of R&D expenditure to assess whether they qualify:

- Expenditure on staff including salaries, employer’s NIC and pension contributions.

- Expenditure on subcontractors and freelancers.

- Expenditure on materials and consumables including heat, light and power that are used up or transformed by the R&D process.

- Expenditure on some types of software.

R&D tax relief is an incentive that can be claimed by companies that undertake innovative projects in science or technology. Companies that can show they have undertaken projects seeking to achieve an advance in science or technology through the resolution of technical or scientific uncertainty are eligible to claim the relief.

If you have created or appreciably improved a product, process, or service because what existed was unable to provide the capability required, and another competent professional in your field would hold out what you have done as advancing knowledge and challenging to achieve there may be a degree of R&D in the project that you can claim R&D tax relief for.

R&D is not restricted to pure scientific research companies but extends to all sorts of sectors, some examples include; software development, construction, pharmaceutical, biotechnology, engineering and food companies.

Businesses have until two years after the end of an accounting period to file a claim i.e. for the accounting period ended 31 December 2021 the filing deadline for the R&D claim is 31 December 2023.

The relief available depends on the size of your company. The cash tax value of claims for SMEs is 21.5% of qualifying expenditure for tax paying companies and 18.6% of qualifying expenditure for loss making companies. Large companies are able to claim the R&D Expenditure Credit (RDEC) which provides a net benefit of c.15%. Loss making companies are able to obtain a repayable credit under both the SME and Large R&D schemes.

HMRC normally processes SME R&D claims within 28 days of receipt of the claim, however currently repayments are taking up to 40 days due to additional checks put in place by HMRC to prevent abuse of the system.

An SME is defined as a group/company with:

- Less than 500 employees, and

- Annual turnover under 100m Euros, or

- Balance Sheet total of not more than 86m Euros.

When calculating the above limits it is necessary to incorporate the data of any group, partner, or linked enterprises.

The following costs can be included in a claim:

- Staff Costs (salary, bonus, employers pension, and social security) to the extent they have directly or indirectly undertaken R&D activities.

- Externally Provided Workers – 65% of the payment to agencies/third party companies for providing resource engaged on the R&D

- Subcontractors – 65% of the payments made to companies or organisations working on the R&D project (SMEs only)

- Consumables– items that have been used up or transformed as part of the R&D work, such that they are no longer useable in their original form. This includes raw materials, software licenses, water, fuel, and power

- Clinical Trial Volunteers – Payments made to volunteers in clinical trials in return for participating in the trial.

- Contributions to independent research- Payments by large companies to organisations carrying out eligible R&D, provided they are carrying out research relevant to your field/industry. They must also be a ‘qualifying body’, individual, or partnership each member of which is an individual. A ‘qualifying body’ is a charity, institution of higher education, scientific research organisation, or a health service body

Yes, an R&D claim should still be possible if you are in receipt of a grant. However if your grant is classified as ‘state aid’ and was given for the same purpose of your R&D project it is likely the project will not be eligible for the SME scheme and a claim under the RDEC scheme should be made instead.

Most R&D claims can be prepared in 4 weeks from receipt of the initial information, however this is largely dependent on a quick turnaround for any additional financial data or technical information requested, including availability for calls to discuss the projects. If shorter turn around times are needed we will always do our best to accommodate.

No you don’t need timesheets to be able to make an R&D claim. Timesheets can make it easier to identify the time spent on R&D but you do not need these to be able to claim, HMRC accept that not all businesses have this data and it is possible to submit a claim based on an estimate of the time spent on R&D.

All claimants are now required to submit an Additional Information Form ‘AIF’ containing information on projects that equate to 50% of qualifying expenditure regardless of accounting period, with the number of projects to be documented depending on the number included in the claim. The AIF must be submitted before the claim is made in the company tax return otherwise HMRC will remove the R&D claim from the return. New claimants (who haven’t submitted a claim in the last three years) with an accounting period starting on or after 1 April 2023 also need to submit a pre-notification form within 6 months of the end of the accounting period to be eligible to file a claim. Company’s who have not claimed for more than three years before the last date of the claim notification period also need to submit a pre-notification form.

Anthony Francis, Pelican Capital

You may also be interested in...

Who we are

We are Wilson Partners. We combine the financial expertise, experience and accessibility of our talented team with a deep understanding of our clients to help achieve their goals.

What’s keeping you awake at night?

Running your own business is no mean feat. It can literally become your life and if you’re not careful, that can have you questioning the very reasons you went into business in the first place.

Our aim is to deliver the highest quality content to help existing and aspiring business leaders to reach their goals quicker. Material is generated primarily by our own team of experts.