Cash flow: Are you a worrier or a warrior? Tips to significantly increase your wealth

There’s no question that the more active you are in all areas of your business, the more successful you’ll be. More often than not, business owners get stuck in a rut of chasing sales and getting caught up in the day-to-day running of their business. Often, one of the first things to get overlooked is cash flow – and the negative consequences of this can be huge. The worst part? It’s a truly vicious cycle: the worse it gets, the more time you spend worrying (often at night) about how you’re going to get paid and how you’re going to cover your own costs.

Imagine the positive impact to your business if that worry was taken away and those hours previously spent wasted on worrying, instead utilised negotiating with suppliers and developing new business? Not to mention the positive impact a good night’s sleep would have.

There is a simple solution to managing cash flow – and the benefits can be huge.

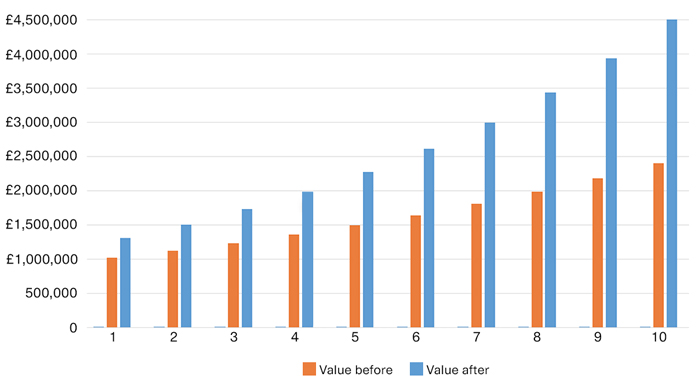

In our illustration below, we show how a £1m turnover business growing at 10% p.a. could reap the rewards of halving debtor days, reducing bad debts and freeing up time. We’ve made some realistic assumptions around average debtor days, bad debts and the incremental uplift in turnover due to slicker operations. The illustration below shows the difference to the company’s value increasing by £2m over the period – an increase of 180%.

With the availability of add-ons to help you automate and streamline your cash collection, getting your money in and using it to grow your business more quickly has never been simpler.

And if you’re a high growth business growing at, say 20% year on year, you can imagine the knock on benefits of improving your cash flow are far greater. So you shouldn’t need much prompting to start thinking about the positive effect this could have on decision making, profit extraction and even an exit!

So, just take time to digest that again..

In 10 years time, your organisation could be worth an EXTRA £2m, how does that sit with your long term goals? All for the sake of a few simple and cost-efficient changes.

So, it’s time to kick your inner worrier into touch and become a cash flow warrior! Here’s a few tips on how this can be achieved – and they’re simple…

Attitude

Before you adopt a new approach to cash flow, you need to check your attitude. This is about making some simple changes to your processes, but more often the biggest barrier is the change in attitude – not only by you but by anyone in your business who’s involved in getting invoices out and money in.

How do you collect cash?

If you have regular / repeat contracts with customers, cash collection can be improved with the introduction of automated collection with direct debits, or the ability to take payments over the phone via credit or debit card. Satago’s free online platform facilitates automated reminders to customers in relation to unpaid invoices and provides credit reports setting out risk levels of customers. An automated system for credit control will have a positive impact on the level of debtors and bad debts – improving cash flow and your bottom line.

Forecasting

If you’re going to start putting your extra cash flow to good use, then you need to begin with some robust forecasting. With powerful data at your fingertips, you can get an informed view of your future cash position. Create ‘scenarios’ to model short and long-term cash flow. We work with Float – cash flow forecasting software which integrates seamlessly with your accounting system to give you an easy-to-use but powerful tool.

Start improving your cash flow in just 24 hours!

The key here is how this is all set up, as the reliability of the data is essential in getting the best out of any cash flow improvements. At Wilson Partners, we’re adept in all areas of business finance and cash management and we can get your new processes up and running within 24 hours.

*Our figures are based on the knock on cumulative effect of good cash management. Estimated sale prices are based upon a profit multiple of 6 and the additional cash generated over the 10 year period. If you want to find out how we can help improve your life whilst adding to the underlying value of your business, why not give us a call on 01628 770 770 or visit our cash flow page to find out how you can get the most from the cloud!

Guide to selling your business

Your simple guide to helping you maximise the value in your business.

Sign up to receive alerts

Call us on 01628 770 770 for a no-obligation chat

You may also be interested in...

New Companies House filing requirements under the Economic Crime and Corporate Transparency Act (ECCTA) 2023.

What’s happening? The ECCTA received Royal Assent in October 2023 and gives more powers to Companies House to play a more significant role in tackling economic crime and supporting economic growth. Introduction of new laws under the ECCTA will be…

Companies House Filing Fee Increases from May 2024

From Wednesday 1st May 2024 the revised Companies House filing fees will come into effect. The change comes following The Economic Crime and Corporate Transparency Act 2023 which allows Companies House increased powers to ensure accuracy, verify the…

April 2024 – Tax News

Happy new tax year In this April issue we highlight some of the key tax changes that take effect from the start of the new tax year. Unfortunately, most of the income tax and national insurance thresholds continue to be frozen, resulting in an…